When the year 2020 started, my architect friend was excited because they had a lot of projects lined up for their small architectural firm. They have several housing projects and a couple of commercial contracts that he and his staff were all looking forward to.

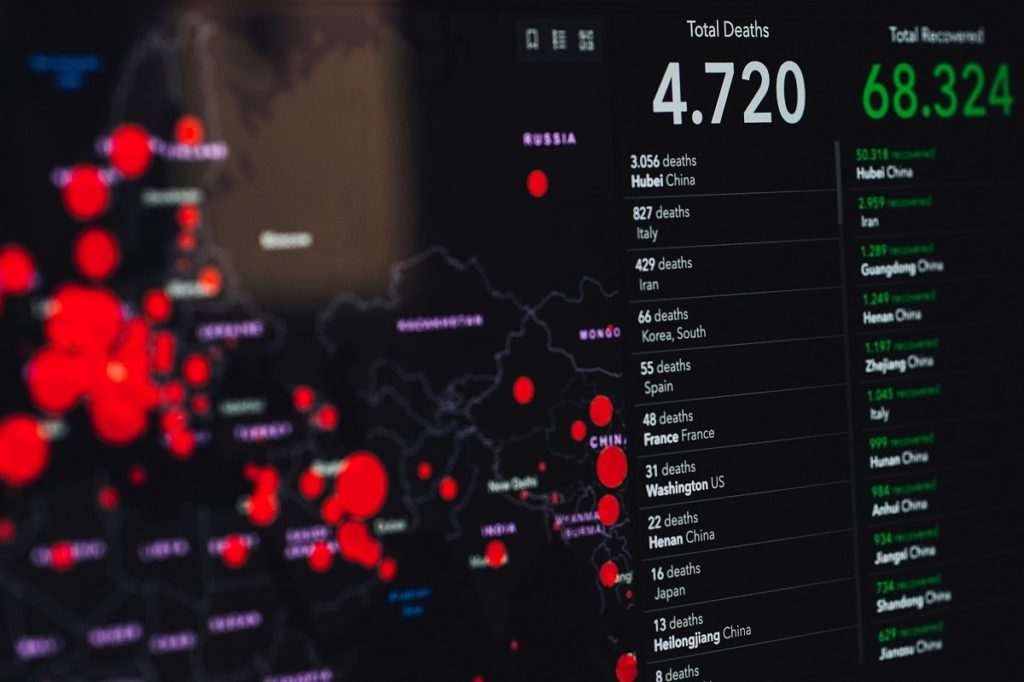

Then the coronavirus pandemic came.

The Harsh Reality

The government urged businesses, especially those non-essentials, to cease operations and close their doors indefinitely as the threat of COVID-19 continues to wreak havoc across the globe. Factories and plants were shut down and employees were sent home wondering how they will survive this health crisis and looming financial crisis.

The shutdown, unfortunately, included his small firm and a lot of other small businesses across America.

While these folks stayed home watching news reports of the possibility of cruise ship and airline companies receiving bailout money from the government, they can’t help but wonder what’s in store for the regular folks who are living from day to day with only their small business to provide for them.

For my friend and countless other small business owners, they can’t see nor point to anything that indicates that the regular Joe is included in the bailout. They fear they might be left to fend for themselves.

Goldman Sachs conducted a survey with 1,500 small business owners and concluded that 96% of them have already been affected by the pandemic, with a little over 50% of them saying they can only remain operational for three months.

A Glimmer of Hope

As a response to these concerns, the government is now looking for ways to help companies with an employee-count of 500 people or less.

The recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act includes provisions for small businesses such as a $349 billion fund specifically for a small business administration or SBA loan in Utah, Nebraska, Iowa, and all U.S. territories.

This paycheck protection program is directed toward job retention and other operational expenses small business owners have during this season. Among those who may qualify for this program are small and tribal businesses, veterans organizations, eligible nonprofits, independent contractors, and self-employed individuals as long as they meet the program’s standards and requirements.

Small business owners may also apply for an Economic Injury Disaster Loan of up to a $10,000 advance. The program also provides small companies and establishments with a maximum of $2 million working capital loan to help them cope with temporary revenue losses.

SBA Express Bridge Loans are also in place to help small businesses that already have working relationships with SBA Express Lenders lessen paperwork for access to a maximum of $25,000. These will be very useful to bridge the gap as businesses await approval for their Economic Injury Disaster loans.

While the government is still doing its best to mitigate the pandemic’s effect on the economy, small business owners can take advantage of these provisions — along with deferred taxes and private loans — to help keep their businesses and employees afloat during these tough times.